- Buffett’s portfolio is valued at $1.86 billion and the portfolio has an annual yield of $42.58 million.

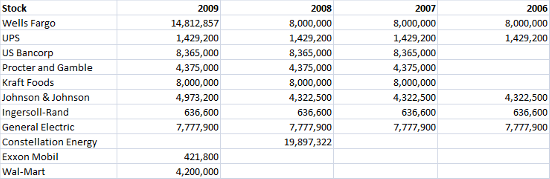

- The portfolio has just 10 stocks and the top holding — Wells Fargo (WFC) — makes up nearly a quarter of the portfolio.

- More than half the portfolio is held in four Dow Jones component stocks: Johnson & Johnson (JNJ), Procter & Gamble (PG), Kraft Foods (KFT) and Wal-Mart (WMT). In fact, two more stocks (Exxon Mobil and GE) in the portfolio are Dow Components.

- The Morningstar article points out that every single business in Buffett’s portfolio has been around for more than a century. The newest business would be UPS, which was founded as recently as 1907.

Some interesting points:

- 2009 was a busy year for Buffett. He increased his holdings in Wells Fargo significantly, added Wal-Mart and Exxon Mobil and sold Constellation Energy.

- Other major holdings are also recent additions. US Bancorp, Procter & Gamble and Kraft Foods were purchased in 2007.

- Overall, the portfolio has very low turnover. Other than Constellation Energy, which was purchased in 2008 and sold in 2009, Buffett adds stocks to the portfolio but rarely sells them."

No comments:

Post a Comment